Bitcoin, Ethereum, Litecoin, and Ripple investment and wealth management are all available on Wefreepay

What are the most worthwhile cryptocurrencies for formal investment in 2025?

There are various types of cryptocurrencies, with Bitcoin, Ethereum, Litecoin, Ripple, and others currently ranking among the top in terms of market value. But in my personal opinion, the most promising and worthwhile cryptocurrencies to invest in are the following.

1. Bitcoin/BTC

Bitcoin is the world’s first cryptocurrency, and to this day, it not only has the oldest history, but is also the most popular cryptocurrency today. And in the mainstream economy, the acceptance of Bitcoin is also increasing. Some well-known companies in the world have started accepting Bitcoin payments, and PayPal, as a global payment giant, was the first to open Bitcoin payment functionality at the beginning of this year. In addition, there will be multiple large institutions such as Grayscale and Galaxy entering the Bitcoin market in the future. The intervention of institutions is bound to drive Bitcoin to a new round of rise, and it will soon break through historical highs again.

Real time Bitcoin quote chart ▼

Sell Buy

2. Ethereum (ETH)

Ethereum is the second most valuable cryptocurrency after Bitcoin in terms of market capitalization. In fact, with the support of “smart contract” technology, Ethereum has become the local currency for all applications on the Ethereum blockchain to conduct transactions. Ethereum is very useful, and many subsequent cryptocurrencies rely on Ethereum for their architecture. Therefore, from the current perspective, Ethereum is irreplaceable. At the same time, Ethereum is constantly improving and innovating. At the end of 2020, the future upgrade of the Ethereum blockchain, Ethereum 2.0, was officially launched. This can be said to be a brand new cryptocurrency that has attracted the attention of many investors since its listing. With its phased release, it is believed that it will also drive Ethereum to perform well in the future.

Ethereum real-time quote chart ▼

Sell Buy

3. Litecoin/LTC

Litecoin is a peer-to-peer network with a cryptocurrency of the same name. As a “simplified version” of Bitcoin, Litecoin’s main purpose is to make cryptocurrency faster and more convenient. In addition, as Litecoin is also designed as a payment tool, and the token is used by various businesses and merchants around the world to pay for clothing and furniture, art and collectibles, health and beauty services, and more. From this perspective, the newly added number of stores and services accepting Litecoin payments may have a positive impact on the price of cryptocurrency.

Litecoin real-time quote chart ▼

Sell Buy

4. Bitcoin Cash/BCH

Bitcoin Cash is the result of a hard fork of Bitcoin, which is both a digital cryptocurrency and a payment network. As a branch of Bitcoin, Bitcoin Cash not only possesses all the advantages of Bitcoin, but also solves the problems of low scalability, high transaction costs, and slow transaction speed that exist in Bitcoin. At present, although Bitcoin Cash is still in its early stages and its market acceptance is not high, we believe that after a period of development and the impact of Bitcoin’s upward trend, Bitcoin Cash will provide investors with a satisfactory answer.

Real time Bitcoin Cash Quote Chart ▼

Sell Buy

5. ChainLink/LINK

LINK is an ERC20 standardized token based on the Ethereum blockchain, mainly used to pay Chainlink node operators to retrieve data from off chain data, format data into blockchain readable format, and ensure normal running time, while helping to connect smart contracts to external resources in different networks. From historical price trends, LINK is a great long-term investment. The current market environment shows that LINK is still in a bullish cycle for the foreseeable future.

ChainLink quotation chart ▼

Sell Buy

6. Tether USD/USDT

Tether is a stable cryptocurrency issued by Tether and anchored 1:1 with the US dollar. It cannot be obtained through mining and is only issued by Tether through the Bitfinex exchange. When the exchange rate between Tether and the US dollar fluctuates, Tether maintains a relatively stable value by issuing or destroying currency. With over 4 billion Tether coins circulating in the cryptocurrency market, other stablecoins find it difficult to compete with them. Although appearing slightly later than other cryptocurrencies, its market value continues to grow at an impressive rate, and we expect Tether to have even better performance in 2025.

7. Ripple Coin (XRP)

Ripple is a relatively centralized digital currency based on the Ripple protocol that can be used for global payments. Its main purpose is to benchmark transfer systems rather than currency, which to some extent limits the value of Ripple. However, this does not mean that Ripple cannot bring investment returns, as at least in 2020, Ripple’s rise reached 43.93%.

Real time Ripple quote chart ▼

Sell Buy

However, cryptocurrency exchange Coinbase recently announced that it will suspend trading of the cryptocurrency Ripple. Although other platforms can still invest in Ripple in the short term, its price will inevitably be affected and fluctuate. If you can seize the opportunity, there is still a chance to make profits from it.

What are the methods of cryptocurrency investment fraud?

Cryptocurrencies have the characteristics of being liquid, easy to carry, and irretrievable after completing transactions. While technological innovation and rapid development of trading models continue to attract a large number of investors, many unscrupulous people are also eager to illegally profit from them.

1. False gift giving

Be wary of seeing messages on social media (Facebook, X, etc.) that say ‘sending 1 Bitcoin to this address will receive X in return’, which is definitely a scam. Even the least favored cryptocurrency has value, and no one will give it away for free.

2. Clone website

Cloning websites are usually replicas of legitimate exchange or ICO project websites, with links that use content very similar to the original website, such as using “l” instead of “1” or “0” instead of “o”. At first glance, it is easy to mistake them for real.

3. Fake mining pools

Fake mining pool refers to Telegram or Discord group chat groups that require sending cryptocurrency to contribute to the mining pool in order to receive ICO token rewards in the later stage. Due to the anonymity of cryptocurrency, once it is invested in a fake mining pool, it cannot be recovered. During the contribution process, investors also need to pay high transaction fees, KYC, and certain specific skills.

4. Increase shipment volume

The group that engages in this scam will manipulate the price and quantity of a cryptocurrency that is not very well received, by coordinating a large number of transactions to inflate the price and sell it at a high price. The higher the price of the coin is inflated, the lower level members within the gang will suffer more losses after purchasing.

What are the legitimate ways to invest in cryptocurrency?

(1) Mining Cryptocurrency

The most traditional way to invest in financial products is to buy at a low price and then sell at a high price, completing the transfer of ownership during the trading process. However, due to the fixed quantity and halving effect of cryptocurrencies, obtaining them will become increasingly difficult. The cost of mining digital currency for each miner will also increase exponentially over time. For ordinary investors, it is difficult to afford such high mining costs. Therefore, it is currently unrealistic to invest in mining digital currencies by becoming a miner.

(2) Cryptocurrency ETF

Exchange Traded Fund (ETF) is a special open-end fund listed on an exchange that tracks changes in the target index.

Similar to the operational mechanism of traditional ETF products, cryptocurrency ETFs typically track one or more cryptocurrencies to achieve risk diversification. In addition, it can also to some extent avoid the high volatility of cryptocurrency prices.

(3) Cryptocurrency CFD

CFD is a contract for difference, which is a leveraged financial derivative instrument that utilizes its potential profits and losses. If investors choose to invest in cryptocurrencies through CFD, they can make mutual profits by predicting the future price of cryptocurrencies with very little initial capital.

If an investor builds a position with a bullish outlook on future prices, it is called holding a long position in a CFD; conversely, if it is bearish, it is a short position. When investors want to close their positions, they need to perform reverse operations by selling or buying CFD.

(4) Off exchange trading

Off exchange trading, also known as OTC trading, is a very flexible investment method with no fixed requirements or restrictions on membership, rules and regulations, trading products, etc. The specific content is negotiated privately by both parties on a one-on-one basis. Therefore, over-the-counter trading inevitably poses significant security risks. Especially when investing in more unstable cryptocurrencies, choosing over-the-counter trading involves significant risks, so extra caution must be exercised and third-party guarantees must be used.

The simplest way to invest in cryptocurrency – CFD contracts for difference

In the previous section, I introduced some investment methods for cryptocurrencies. However, considering the risks involved in cryptocurrency investment, I am more inclined to recommend investing in cryptocurrencies through CFD (Contract for Difference) because cryptocurrency CFD has some unique advantages that can help you mitigate investment risks.

✅ Compliance supervision. Although cryptocurrencies are not yet regulated, the trading platforms that offer cryptocurrency CFD currently operate under the management of legitimate regulatory agencies, so you can rest assured about the security of cryptocurrency trading.

✅ No physical investment. The trading process of CFD contracts for difference does not involve physical cryptocurrencies, which means you do not have to personally experience the complex mining process, and you can invest in cryptocurrencies without owning them. Moreover, the specific steps of CFD contract for difference trading are also very simple.

✅ The trading volume is small. Although a standard cryptocurrency contract for difference has a size of 1 lot, you can start trading from a minimum of 0.01 lots.

✅ Two way profit opportunities. CFD contracts for difference can effectively avoid the drastic price fluctuations of cryptocurrencies. Through CFD contracts for difference, investors can predict the future price of cryptocurrencies from both long and short directions, without affecting their profits from the price difference, regardless of whether it rises or falls.

✅ Low threshold, high returns. CFD contracts implement a margin trading system, so you don’t have to worry about being unable to afford the high prices of cryptocurrencies. For cryptocurrency CFD, it is actually possible to open large contracts with minimal funds and obtain higher returns under the amplification effect of leverage.

✅ A trading account invests in multiple products. After opening a CFD account on the trading platform, in addition to cryptocurrency, you can also trade nearly a hundred popular investment products such as foreign exchange, commodities, stocks, etc. at the same time.

Since I started trading cryptocurrency CFD, I have compared several CFD trading platforms and in my opinion, Mitrade has the highest overall evaluation. On the Mitrade platform, you can trade 5 cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, Ripple, and Litecoin, and use up to 1:10 leverage to open positions as low as 0.01 lots.

We are currently holding a new user deposit activity starting immediately! Register to receive USD10, with a maximum bonus of USD100!

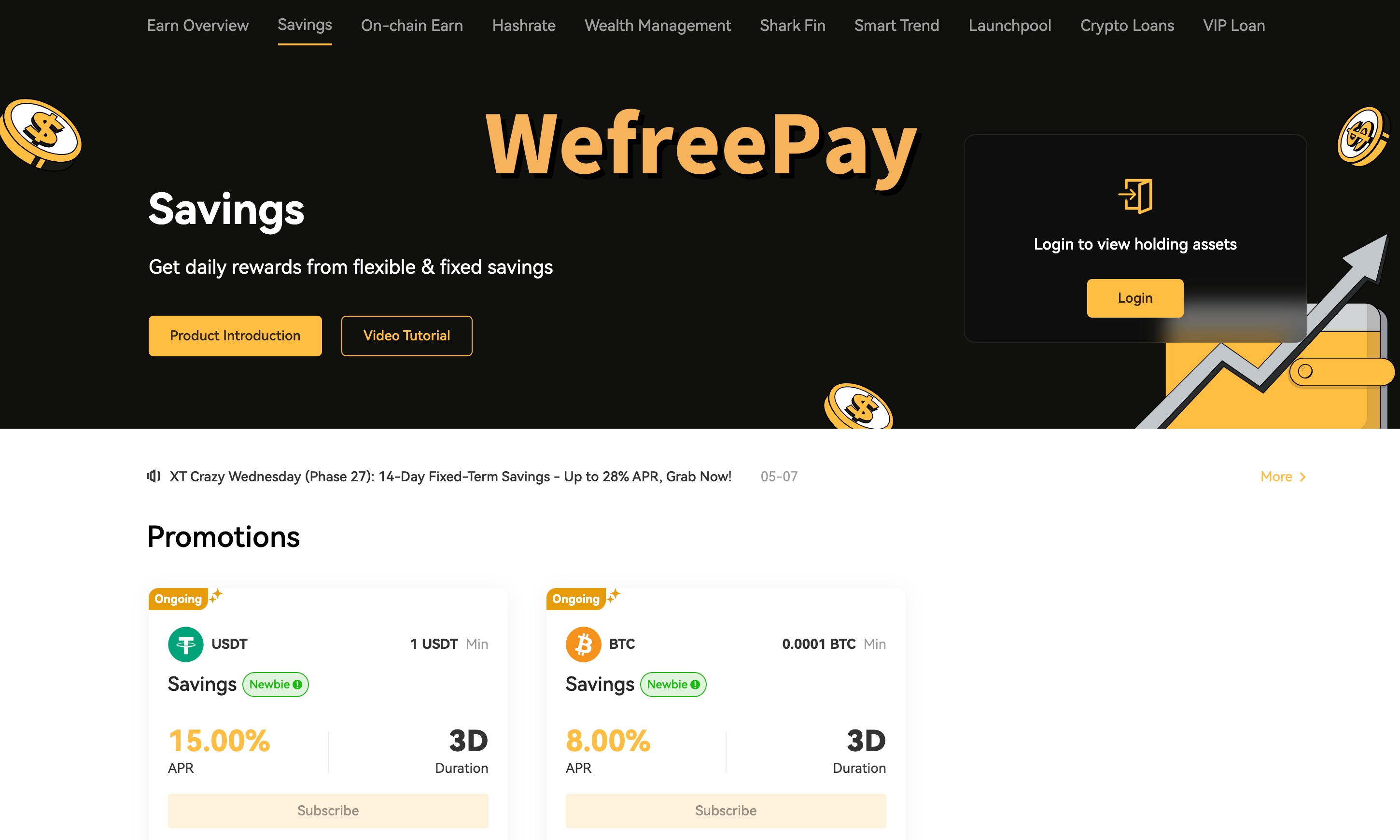

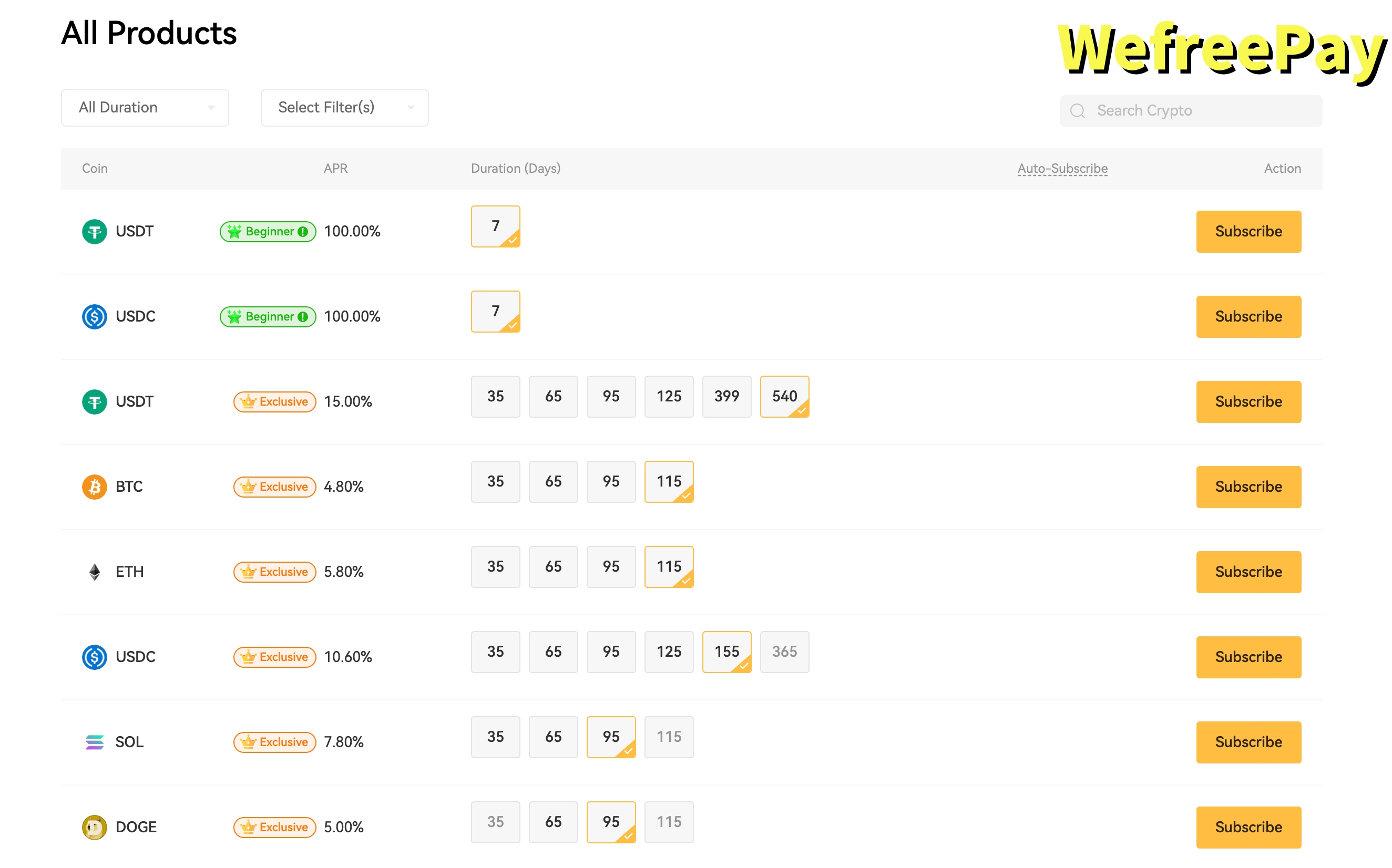

Immediately invest and manage Bitcoin, Ethereum, Litecoin, and Ripple with a free demo account starting from Wefreepay, offering a $50000 demo experience bonus to help you practice trading strategies at zero cost.

3 Simple Steps to Embark on a Forex Trading Journey

one

register

Fill in the information and submit your application

two

Deposit

Multiple ways to quickly deposit funds

three

transaction

Discover trading opportunities and place orders quickly

start immediately

*Wefreepay is the preferred choice for small foreign exchange investments, with flexible leverage and a deposit threshold as low as 50 USD!

summarize

In summary, investing in cryptocurrency is a challenge that combines risks and opportunities. In order to maximize the success of your investment, besides choosing currencies with promising development prospects, entering the market is also crucial. If you, like me, prefer to invest prudently, then cryptocurrency CFD is really worth a try, as there is no method with lower cost and lower risk than CFD contracts.